Sharemarkets continued to make headlines in the 2024-25 financial year but the best performers for investors seeking high returns broadened to include a much wider range of investment types.

Investors looking for strong returns were able to find them in a growing number of investment categories over the 2024-25 financial year as several investment types dramatically outperformed their 10 year average performance.

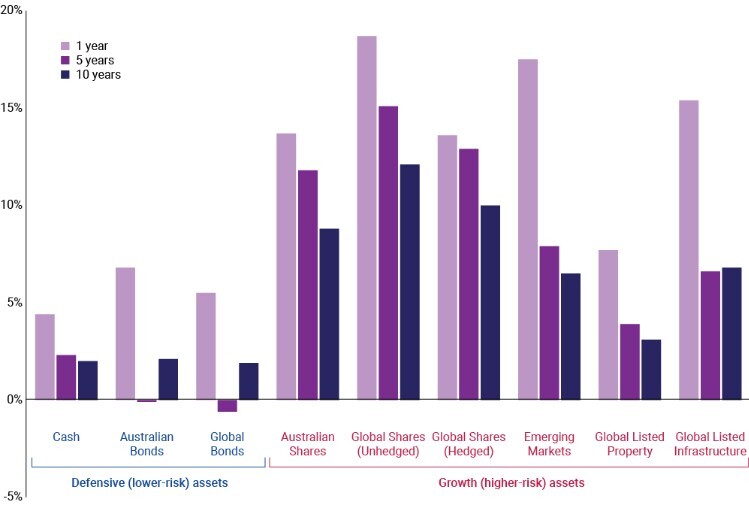

Unhedged global shares – which may be affected by fluctuations in the currencies used to conduct the trades – were the top performer in the year to 30 June 2025, delivering a return of 18.7%. This was only slightly less than their 2023-24 financial year return of 19.3%, despite increased market volatility; and remained well above their 10 year average return of 12.1%.

However, emerging markets, listed global infrastructure and even Australian bonds were among the highest returning asset types, delivering big gains compared with both the previous financial year performance and their historical averages.

The results were revealed in market data showing how different investment types performed over the financial year to 30 June 2025*. They demonstrated the resilience of sharemarkets despite changed global trading conditions following the US government’s decision to implement widespread tariffs on imported goods.

However, they also revealed that investors seeking high returns were less dependent on the

tech-led and AI driven companies that fuelled performance growth in 2023-24, as other asset types showed dramatic improvements.

Best investment performers included established and emerging asset types

Among the star performers of the past financial year, emerging markets returned 17.5% for the 12 months to June.

This was a big improvement on the 12.2% they generated in 2023-24 and close to triple their average 10 year return of 6.5%.

Listed global infrastructure made a sharp gain in 2023-24, delivering a return of 15.4%. This was a sixfold improvement on the 2.4% return it delivered during the 2023-24 financial year, marking a spectacular turnaround with a performance that was well above its 10 year average of 6.8%.

And Australian bonds returned 6.8% last financial year – more than three times their 2.1% average return over 10 years.

Investment market performance over 2024-25, 5 years and 10 years*

Strong investment returns across the board

All major investment types outperformed their 10 year average returns during the 2024-25 financial year, the performance data shows.

Australian shares returned 13.7% during 2024-25, significantly better than their 11.9% return during the previous financial year and well above their 8.8% historical return.

Hedged global shares provided a return of 13.6%, down from the heady 19.8% growth they offered in 2023-24 but well above the 10.0% they delivered over 10 years.

Even low-risk asset types, such as global bonds, delivered returns more in line with the traditional returns of ‘growth’ investment types.

Global bonds provided a return of 5.5% – well above their 10 year average return of 1.9%, while cash delivered 4.4% growth – the lowest of all but more than double its 10 year average.

* Benchmark performance annualised for periods greater than one year is shown for: Bloomberg AusBond Bank Bill Index; Bloomberg AusBond Composite 0+ Yr Index; Bloomberg Global Aggregate AUD Hedged; S&P/ASX 300 Accumulation Index; MSCI ACWI Ex-Aus Index Special Tax Net AUD Unhedged; MSCI ACWI Ex-Aus Index Special Tax Net AUD Hedged, MSCI Emerging Markets (AUD), FTSE EPRA/NAREIT Dev ex Aus Rental Index AUD Hdg Net and FTSE Dev Core Infrastructure Index AUD Hdg Net.

Source: Colonial First State