How do hedge funds work in a volatile market?

While an exposure to hedge funds can provide a lift to a portfolio’s performance, they also offer the potential to generate high returns – at…

How old is too old for insurance?

As you age and your health starts to deteriorate, having a financial safety net and protecting your nearest and dearest may become even more import…

Impacts from Falling Home Prices: The Wealth Effect

The impacts of interest rate hikes on consumers are well known; higher interest means that mortgage debt servicing costs will go up which is negati…

Alternative Thinking: Diversifying Beyond Traditional Asset Classes

Once a staple investment allocation, the traditional balanced portfolio of shares and bonds has had some challenges in delivering positive returns …

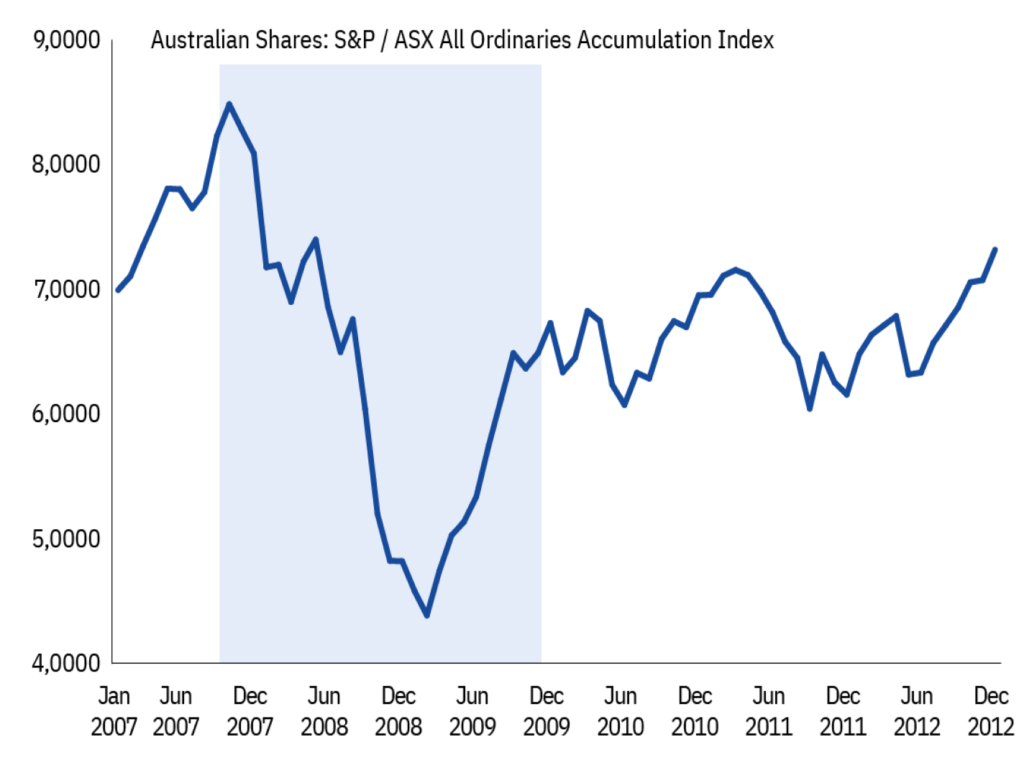

Why staying invested matters when markets fall

It’s natural to feel nervous when markets fall. News about inflation and rising interest rates may prompt you to make an emotional investment decis…

Booms, busts and investor psychology: Why investors need to be aware of the psychology of investing

Up until the 1980s the dominant theory was that financial markets were efficient. In other words, all relevant information was reflected in asset p…

Economic and market overview

Pleasingly, global share markets fared well in October and recovered most of their lost ground from September. Locally, the S&P/ASX 200 Index r…

3 things to consider if your Super balance falls

From time to time, market movements may cause your super balance to fall. While this can be alarming, you’ll find that it usually recovers in…

What you should know about creating your will and estate plan

If you want to protect your family and assets, it’s worth documenting what you’d like to happen if you can’t make your own decisions later in life …

What are some investment options outside of super

When it comes to investing, you have two options – inside or outside of super. Super, being a longer-term investment designed to fund your retireme…