What are the steps to investing?

Want to invest but don’t know where to start? Here are five basic steps for investing. Define your goals Taking the first step on your investment j…

How to give your finances a health check

How healthy are your finances? Isn’t it time you put your own financial wellbeing front and centre? You can take control of your financial future q…

Getting smart about savings

Saving money doesn’t come naturally to everyone. Some people are wired to save – for others it takes a bit more discipline. But developing good sav…

How much super should you have at your age?

Your super balance will most likely play a big part in how comfortably you live in retirement. But depending on how far off retirement is for you, …

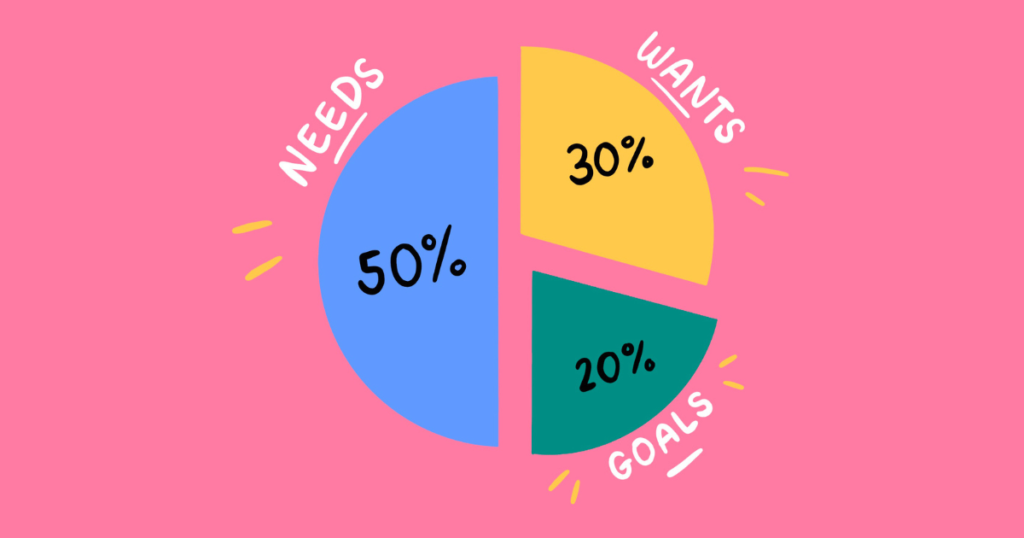

50/30/20 budgeting strategy

Having a budget can help you stay on top of bills, pay off debt and save for long or short-term goals. There are many ways to go about it. One budg…

2023 saw the return of Goldilocks, but what’s in store for 2024 for investors?

Key points The five key themes for 2023 were: better than feared growth; disinflation; peak interest rates (probably in Australia too); lots of geo…

Five constraints on medium term investment returns

Introduction Starting in the early 1980s investment returns were spectacularly strong. Sure there were bumps along the way like the 1987 share cras…

Financial freedom: A comprehensive guide to achieving true financial independence

In a world where financial stability plays a crucial role in our wellbeing and future aspirations, the concept of financial freedom stands out as a…

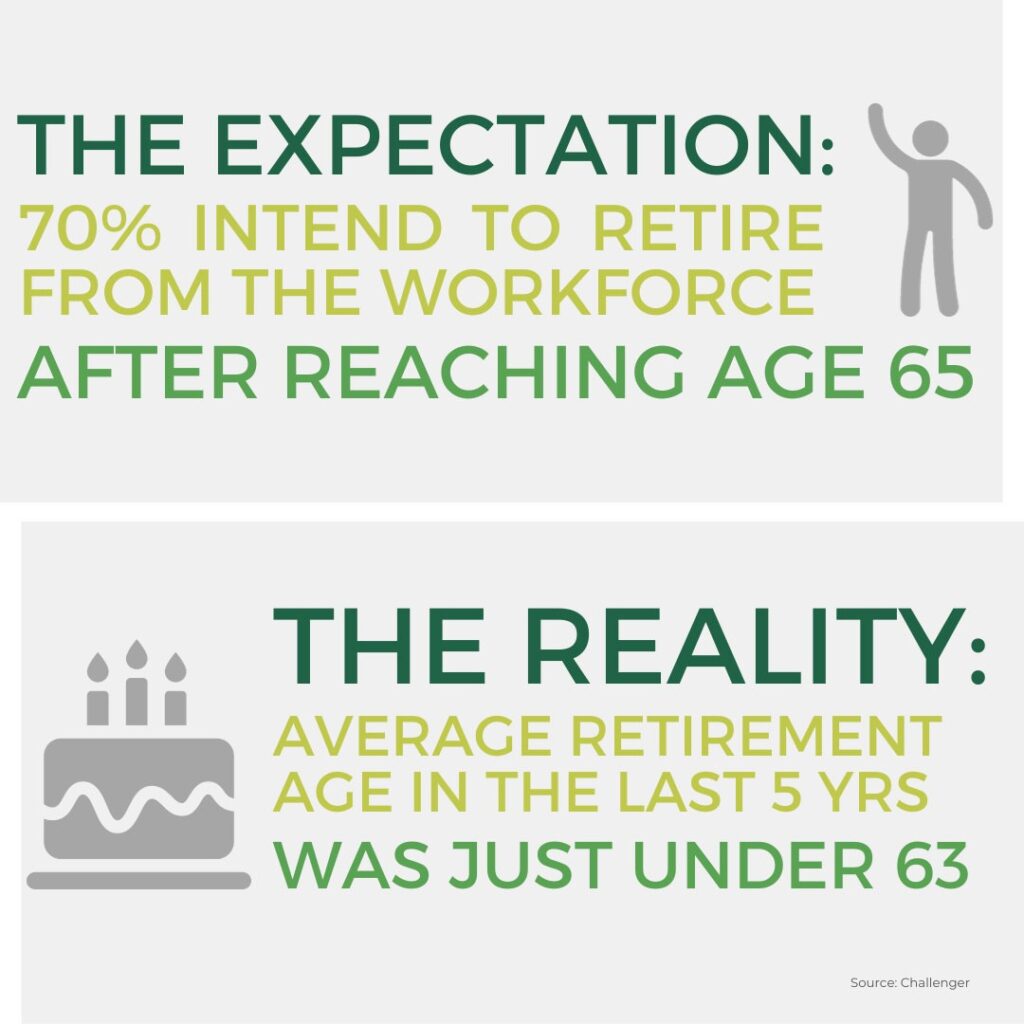

What’s the best age to retire?

There is no magic age at which to retire. But what’s important is to plan for a longer retirement than you may expect. This is in part because rese…

A real cybercrime story

Australians lost over $3 billion to scams in 2022 alone. With investment scams being the most common, consider these insights so you can better pro…